India Tax Calculator FY2012-13

6(已有0人评分)我要评分

- 版 本:

- 2.1.2

- 类 型:

- 办公商务

- 下载量:

- 55

- 大 小:

- 2.03MB

- 时 间:

- 2017-05-16

- 语 言:

- 其他

关闭纠错举报

我站仅对该软件提供链接服务,该软件内容来自于第三方上传分享,版权问题均与我站无关。如果该软件触犯了您的权利,请点此版权申诉。

+ 展开全部应用介绍

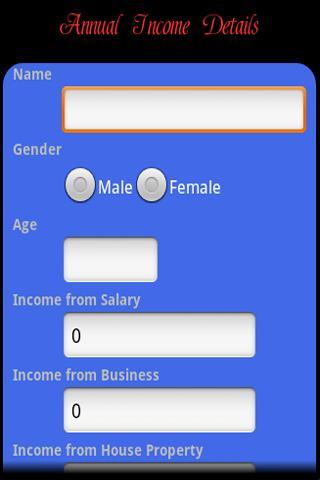

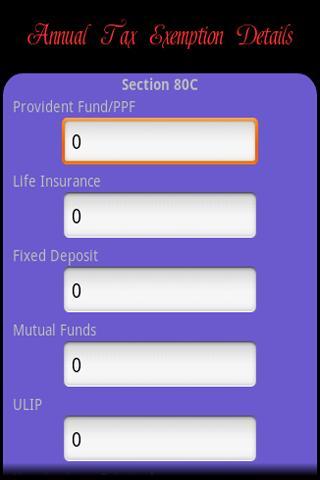

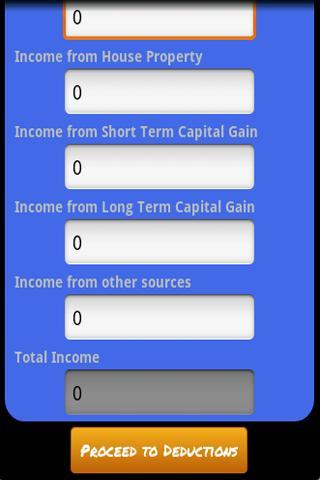

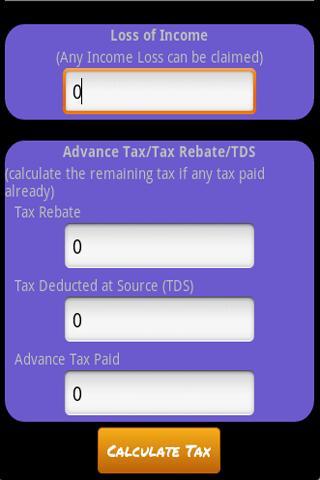

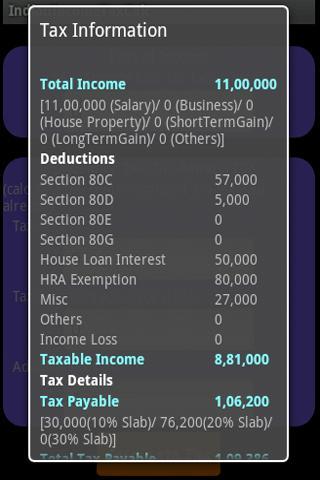

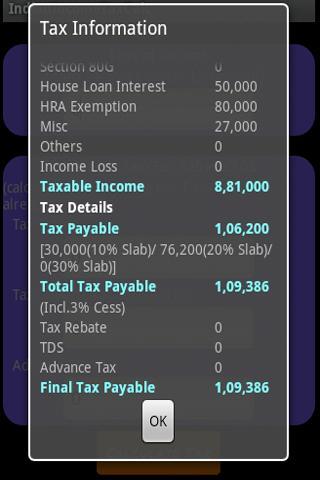

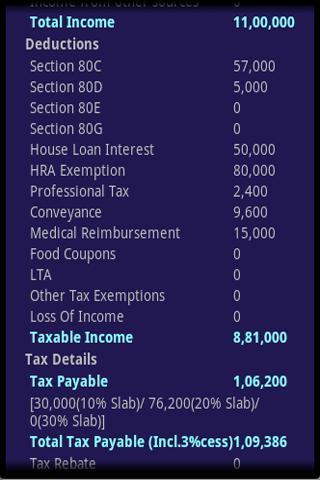

Income Tax Calculator for India: (FY 2012-2013/AY 2013-1014)Advance and Quick Tax Calc provided in the App.Calculate the Income Tax for the Financial Year 2012-2013 (Assessment Year: 2013-14). In the App, the tax calculations can be saved in a record, and the record can be updated/deleted anytime. For quick tax calculations, a quick tax calculator is provided.Here are the rules considered in the app:Income Tax Rates for Financial Year 2012-2013: Case A: For Men (less than 60 years)Upto Rs. 2,00,000 NilRs. 2,00,001 to Rs. 5,00,000 10 per centRs. 5,00,001 to Rs. 10,00,000 20 per centAbove Rs. 10,00,000 30 per centCase B: For Women (less than 60 years)Upto Rs. 2,00,000 NilRs. 2,00,001 to Rs. 5,00,000 10 per centRs. 5,00,001 to Rs. 10,00,000 20 per centAbove Rs. 10,00,000 30 per centCase C: For resident individual of 60 years or above (Senior Citizens)Upto Rs. 2,50,000 NilRs. 2,50,001 to Rs. 5,00,000 10 per centRs. 5,00,001 to Rs. 10,00,000 20 per centAbove Rs. 10,00,000 30 per centCase D: For resident individual of 80 years or above (Very Senior Citizens)Upto Rs. 5,00,000 NilRs. 5,00,001 to Rs. 10,00,000 20 per centAbove Rs. 10,00,000 30 per centHRA Tax Exemption Calculation:Minimum of (40 or 50% of Basic, Annual HRA Claimed, Annual Rent Paid – 10% of Basic)Maximum allowed limits for tax exemption:Section 80C limited to 1 Lac.Section 80D limited to 35K.Section 80E limited to 40k.Section 24 limited to 1.5 Lac.Limitations of the App: 1. As all the values are considered as integers, the maximum value can be entered is (2^31 - 1).2. While doing calculations, each value is rounded to the nearest integer.Suggestions:If any rules are violated or for any suggestions, please send an email to arbandroidapps@gmail.com

应用截图

你可能还会喜欢

发表评论共有 0 条软件评论

- 本软件还没有玩家发表评论,快来抢占沙发吧:)